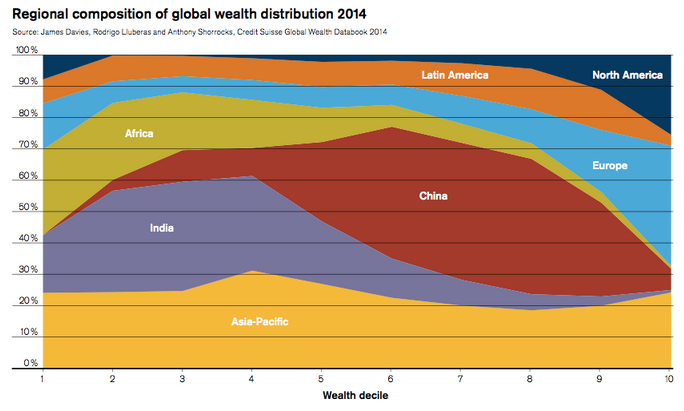

The Global wealth report of Credit Suisse is out! With the special topic: wealth inequality!

…and this is what The Economist has made of it

http://www.economist.com/blogs/graphicdetail/2014/10/daily-chart-8

A bit of background on market crashes. As a warning, I have seen different numbers as well…

http://awealthofcommonsense.com/heading-another-crash/

Some thoughts on oil/OPEC

http://ftalphaville.ft.com/2014/10/14/2005952/when-the-cartel-bursts-brent-edition/

Which fits in nicely with this chart of The Economist: how oil affects the financial state of numerous countries…

http://www.economist.com/blogs/graphicdetail/2014/10/daily-chart-7

…and here is some more on oil…

http://online.wsj.com/articles/opec-competition-pushes-crude-lower-1413194740

This one fits in nicely with the theme: emerging markets sensitivity to commodity shocks

http://ftalphaville.ft.com/2014/10/14/2006642/how-will-ems-be-affected-by-commodity-price-declines/

Are there still inflationistas out there? Anywhere?

http://www.businessinsider.com/breakevens-making-new-lows-2014-10

This one is for the infrastructure huggers out there…

http://www.bruegel.org/nc/blog/detail/article/1457-infrastructure-investment-is-a-no-brainer/

I have probably shown this one before. Still a nice chart though.

http://www.businessinsider.com/oecd-disaster-charts-2014-10

“South Florida, in particular, is a sitting duck.” I picked this one because of that line. No clue if it is true

Lukas Daalder is in het verleden wel eens als ‘Nederlands best bewaarde geheim’ op het gebied van economie genoemd. Hij publiceert dagelijks een collectie met grafieken, nieuws en informatie over internationale economie en financiële markten. Het aardige is dat je zijn updates in minder dan een minuut gelezen kan hebben, maar dat er tegelijkertijd voldoende stof tot nadenken tussen staat. Lukas is het hoofd van de afdeling Global Allocations en is tevens portfolio manager bij Robeco. Alle meningen in zijn updates zijn op persoonlijke titel.

Disclaimer: All links provided are collected from public websites, unless otherwise specified. I have not checked the data or information for accuracy used, and therefore do not guarantee that all data provided will be 100% correct. The links provided do not necessarily reflect my personal opinion and should be seen as general interest: oftentimes I do not agree with arguments presented, but nevertheless think it is worthwhile to read them. It is up to the reader to make up their own mind. Suggestions or discussions are more than welcome. Do not quote unless specifically cleared beforehand!

Alle edities? Hier.